For more information on preparing to sell your home, visit my Home Selling Guide:

Remodeling Projects to Avoid When Selling Your Home

It’s common for homeowners to feel compelled to remodel their homes before they sell. Renovating the spaces in your home can increase its value and help you compete with comparable listings in your area. However, some remodeling projects are more beneficial than others as you get ready to hit the market. Always talk to myself or another local agent to determine which projects are most appealing to buyers in your area.

When preparing to sell your home, you want to strike the right balance of upgrades. Making repairs and executing renovations will attract buyer interest, but you don’t want to dump so much cash into remodeling that you won’t be able to recoup those expenses when your home sells.

So, how do you know where to focus your efforts? Your agent is a vital resource in understanding your specific situation—I typically offer guidance to my clients on remodeling efforts that will help sell their home for the best price. Here are a few projects sellers will want to keep off their to-do lists for the best return on investment…

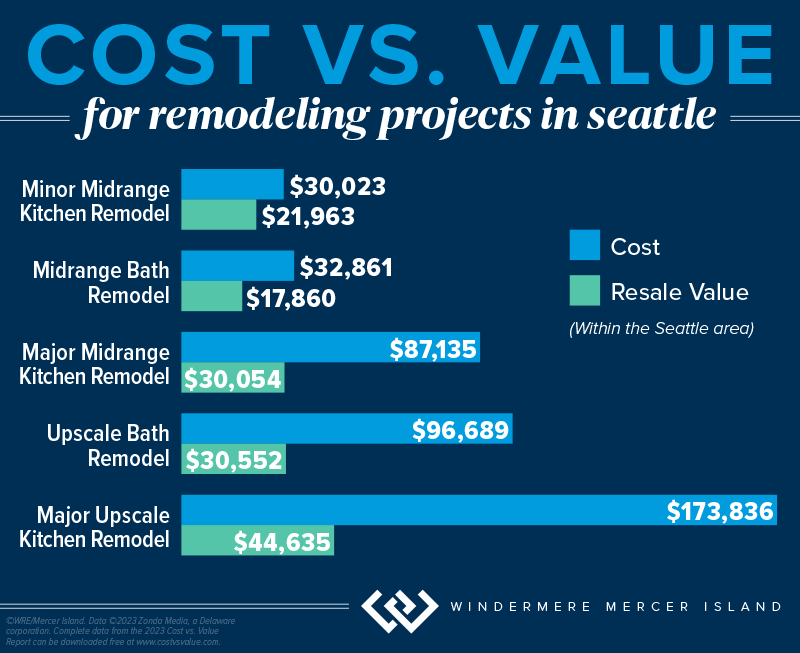

Major, Pricey Upgrades with Long Timelines

For any remodeling project, an analysis of your home’s value will be key to helping you determine its risk/reward potential (reach out if you’d like one for your home). This dynamic is especially important for big remodels and home upgrades, due to their higher costs. The latest Remodeling Cost vs. Value Report (www.costvsvalue.com)1 data for the Seattle area shows a generally negative return on investment for major, upscale remodeling projects—they only recouped about 25%-30% of their cost…

These projects come with hefty price tags and longer timelines than minor repairs and upgrades, which can complicate factors as you prepare to sell, especially if you have a deadline to get into your new home. They have the potential to temporarily displace you from the property, meaning you and your household may have to find somewhere else to stay until the project is complete.

The Bottom Line: To go through with a major home upgrade before you sell, its schedule must fit with your moving timeline. It should also align with buyer interest in your local market. If the project doesn’t meet these criteria, it should be avoided.

Non-Permitted Projects & Building Code Violations

Before you decide to finish out the basement or make changes to your home’s wiring/structure/mechanical systems, it is important to make sure you obtain the proper city, county and/or state permits + inspections. Non-permitted square footage does not reflect on the county tax record and can lead to low appraisals when the buyer tries to get a loan. Obtaining permits also helps ensure your alterations meet the current building code—otherwise, you may face legal exposure should they create a safety hazard. Furthermore, any non-permitted remodels must be disclosed to the buyer on your Form 17 if you live in Washington State. The buyer’s mortgage lender may also have stipulations saying that the loan may not be used to purchase a home with certain features that aren’t up to code, which could lead to them backing out of the deal.

If you’re selling an older home, you’re not obligated to update every feature that may be out of code to fit modern standards. These projects are often structural and require a significant investment. If the violation in question was built to code according to the regulations at the time, then a grandfather clause typically applies. However, you’ll need to disclose these features to the buyer.

Trendy Makeovers and Upgrades

Lastly, it’s best to avoid remodeling projects that target a specific trend in home design. Trends come and go. Timeless design is a hallmark of marketable homes because it appeals to the widest possible pool of buyers. Keep this in mind when staging your home as well. Creating an environment that’s universally appealing and depersonalized allows buyers to more easily imagine the home as their own.

Wondering which remodeling projects might help your home sell? Reach out any time…I’m never too busy to discuss your options and offer advice based on the current market.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island.

1©2023 Zonda Media, a Delaware corporation. Complete data from the 2023 Cost vs. Value Report can be downloaded free at www.costvsvalue.com.

Adapted from an article that originally appeared on the Windermere Blog, written by: Sandy Dodge.

Tax Benefits Every Homeowner Should Know About

It’s tax season again, but being a homeowner might just make it rain at refund time. Check out the tax-deductible expenses, exemptions, and credits below. Whether you own a house, condo, or mobile home, they can save you big money when you file. Just be sure to compare your total itemized deductions against the standard deduction and see which is higher (you’ll have to choose between standard OR itemized on your return). It’s also good to know what you can’t deduct before you land in hot water with the IRS…

Mortgage Interest

A house payment is comprised of two parts: principal and interest. The principal goes toward reducing the amount you owe on your loan and is not deductible. However, the interest you pay is deductible as an itemized expense on your tax return. You can generally deduct interest on the first $750,000 of your mortgage (or $375,000 each if you’re married filing separately) if you purchased your home after December 15th 2017. Those who purchased earlier (10/14/1987 – 12/15/2017) can deduct interest paid on up to a $1m mortgage.

Property Taxes

You can deduct up to $10,000 of property taxes you paid (or $5,000 if you’re married filing separately). If you have a mortgage, the amount you paid in taxes will be included on the same annual lender statement that shows your loan interest information. If you paid the property taxes yourself but don’t have receipts, you should be able to locate the total tax amount on your county assessor’s website.

Home Improvements

Making improvements on a home can help you reduce your taxes in a few possible ways:

- If using a home equity loan or other loan secured by a home to finance home improvements, these loans will qualify for the same mortgage interest deductions as the main mortgage. Only the interest associated with the first $100,000 is deductible (and if you’ve already maxed out the interest deduction on your main mortgage, you won’t be eligible for any additional deduction for this loan).

- Tracking home improvements can help when the time comes to sell. If a home sells for more than it was purchased for, that extra money is considered taxable income. However, you are allowed to add capital improvements to the cost/tax basis of your home thereby reducing the amount of taxable income from the sale. Keep in mind that most taxpayers are exempted from paying taxes on the first $250,000 (for single filers) and $500,000 (for joint filers) of gains.

- Home improvements made to accommodate a person with a disability (yourself, your spouse, or your dependents who live with you) may be deductible as medical expenses. Examples include adding ramps, widening doorways/hallways, installing handrails or grab bars, lowering kitchen cabinets, or other modifications to provide wheelchair access.

- If you live in Washington State and apply with your county prior to construction, you may be able to get a 3-year property tax exemption for major home improvements (including an ADU or DADU) that add up to 30% of the original home’s value.

Home Office Deduction

If you run a business out of your home, you can take a deduction for the room or space used exclusively for work as your principal place of business. This includes working from a garage, as well as a typical office space. Unlike most of the other deductible expenses, you can deduct home office expenses even if you opt to take the standard deduction.

This deduction can include expenses like mortgage interest, insurance, utilities, and repairs, and is calculated based on “the percentage of your home devoted to business use,” according to the IRS.

Home Energy Tax Credits

For homeowners looking to make their primary home a little greener, either the Energy Efficient Home Improvement Credit or the Residential Energy Clean Property Credit can help offset the cost of energy efficiency improvements. Even better, these are credits, which means they directly lower your tax bill.

- Energy Efficient Home Improvement Credit: 30% of the cost for qualified high-efficiency doors, window, insulation, air conditioners, water heaters, furnaces, heat pumps, etc. Maximum credit of $1,200 (heat pumps, biomass stoves and boilers have separate max of $2,000).

- Residential Clean Energy Credit: 30% of the cost for adding qualified solar/wind/geothermal power generation, solar water heaters, fuel cells, and battery storage.

What You Can’t Deduct:

- Mortgage Insurance (this is a change as of 2022)

- Title Insurance

- Closing Costs

- Loan Origination Points

- Down Payment

- Lost Earnest Money

- Homeowner’s Dues*

- Homeowner’s/Fire Insurance*

- Utilities*

- Depreciation*

- Domestic staff or services*

*Unless it’s related to your home-office deduction—contact your tax pro to see if it’s a qualified deduction for you.

Do you have a low-income, disabled or senior homeowner in your life? Check out this article on King County property tax relief.

Psst…every homeowner’s financial situation is different, so please consult with a tax professional regarding your individual tax liability.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island.

Adapted from an article that originally appeared on the Windermere Blog, written by: Chad Basinger.

To Sell or to Rent? The Perks and Pitfalls of Being a Landlord

Analyzing whether to sell or rent your home is a BIG deal…and it deserves careful consideration. Ultimately, the right choice for you depends on your financial situation, goals, and personal preferences. Here is a quick run-down to help you decide:

Renting Out Your Home Might Make Sense If…

- You don’t need the funds from your current home to purchase another home

- You’re moving temporarily and planning to return to the area

- You think your home’s value will drastically increase within the next few years

- The rental market is especially hot in your area

- You have the time and know-how to screen tenants, manage rent/collections, and make home repairs (or would have enough cash flow to pay for third-party management)

- Rental income is part of your long-term investment strategy

Selling Your Home Might Make Sense If…

- You need to use the equity from your current home to purchase another home

- Rent wouldn’t generate enough cash flow to cover things like vacancies, maintenance, repairs, and landlord insurance in addition to the existing mortgage, taxes, and HOA dues

- You don’t want to take on the risks, time commitment, and challenges of being a landlord

- You’re uncomfortable with the landlord-tenant laws in your area

- A home sale would generate a large profit (and has been your primary residence for at least 2 out of the last 5 years so that you’re eligible for capital gains tax exemptions)

- You’re concerned a future recession might negatively impact your finances

Before reaching a conclusion, it’s a good idea to familiarize yourself with the landlord-tenant-law specific to your state (and in some cases, separate relevant ordinances in the city and/or county that your property lies within). You should also do some market research to get a feel for price/condition of similar homes for rent and for sale in your neighborhood.

It probably makes sense to talk with a property management professional to clearly understand what you can expect to net as a landlord. You can also reach out to me any time for an accurate estimate of your home’s value should you decide to sell.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2023, Windermere Real Estate / Mercer Island.

5 Home Improvements That Will Boost Your Property Value

A home is the largest investment most people will make in their lifetime, so when it comes time to sell, homeowners often wonder what they can do to get the most return on their investment. Many have the misconception that remodeling is the way to go, but that isn’t always the case. Rather than going all-in on upgrading your home, you should know which home improvements are worth it, and which ones aren’t.

We’ve sifted through the research and come up with a quick list of five home improvements that’ll help buyers fall in love with your home when it comes time to sell.

1. Add a little curb appeal

Curb appeal is critical. As the name suggests, it’s the first thing buyers see when pulling up to the front of any home so it needs to be in nearly pristine condition.

Landscaping can go a long way for a minimal upfront investment. Six rounds of fertilizer and weed control will set you back about $415, but when it comes time to sell, you’ll see a return on investment (ROI) of about $900 according to a 2023 survey by the National Association of Realtors.

Other improvements you can easily make to your curb appeal include:

- Pressure wash the exterior

- Liven up your front door with a fresh coat of paint

- Replace hardware such as doorknobs and knockers

- Install updated house numbers

- Make your walkways pop with new greenery or flowers

- Plant a succulent garden

- Update your porch lights

- Add a little charm with window flower boxes

- Stage your porch

2. Convert your HVAC to an electric heat pump

According to the 2023 Cost vs. Value Remodeling Report, replacing an oil or gas furnace with an electric heat pump is one of the hottest trends (and offers an unusually high ROI of 104%). Their earth-friendly efficiency is especially appealing to younger buyers and those concerned about climate change. Additionally, they offer summertime cooling, which is a big bonus in the PNW given our recent hot and smoky summers!

3. Refresh your kitchen

While major kitchen renovations are costly and typically have low ROI, a little elbow grease and modest budget can give you big bang for your buck (see our article on simple kitchen makeover ideas).

Here are some smaller updates to boost your home’s value:

- Clean

- Organize your pantry

- Use a little Murphy Oil Soap and hot water on all of your cabinets

- Polish cabinets with Howard Feed-In-Wax

- Tighten all hinges

- Clean grout and tiles

- Shine your sinks and hardware until you can see your face in it

- Deep clean your stove

- Give your kitchen a fresh coat of neutral paint

- Update lighting fixtures, and replace light bulbs

- Add new and trendy door hardware to your cabinets

- Consider replacing your countertops with a hard surface like quartz or quartzite

- Upgrade your appliances

4. Go green

Today’s younger generations are embracing eco-friendly living, and millennials are leading the pack. According to the National Association of Realtors’ 2022 Home Buyer and Seller Generational Trends Report, millennials make up the largest segment of buyers, holding strong at 43 percent of all buyers.

When it comes to attracting buyers who are willing to pay top dollar, going green makes sense. A Nielson study found that, of more than 30,000 millennials surveyed, 66 percent are willing to shell out more cash for conservation-conscious, sustainable products. Depending on where you live, consider installing solar panels, wind turbines, and eco-friendly water systems.

No matter where you live, attic insulation replacement and weather stripping are safe bets. Attic replacement costs can vary but typically have a good ROI. Weather stripping costs about $350 if you hire a professional, but you can easily DIY for a fraction of that cost.

5. Install hardwood floors

Installing or upgrading hardwood floors is pretty failsafe as most buyers love it. Ninety-nine percent of real estate agents agree that homes with hardwood floors are easier to sell, and 90 percent of agents say that they sell for a higher sale price, according to the National Wood Flooring Association. Similarly, a survey by the National Association of Home Builders (NAHB) found that wood flooring was among the top 10 home features most desired by home buyers.

When it comes time to sell, I will help you get the highest possible ROI for your home. I can connect you with tried-and-true contractors, suggest strategic upgrades, and help you develop the right pricing plan based on up-to-the-minute market analysis. Reach out for a complimentary home value consultation.

© Copyright 2023, Windermere Real Estate/Mercer Island.

Adapted from an article that originally appeared on the Windermere blog November 12, 2018. Written by: Sarah Stilo with HomeLight.

Cost vs. Value data ©2023 Zonda Media, a Delaware corporation. Complete data from the 2023 Cost vs. Value Report can be downloaded free at www.costvsvalue.com.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

7 Simple Ways to Boost Your Curb Appeal

When it comes time to sell your home, first impressions are crucial. Improving your curb appeal will catch buyers’ attention and go a long way toward selling quickly and for the best price. Here are seven affordable changes you can make that have a big impact…

1. Lush Up Your Lawn

A healthy, well-tended lawn will make your home look even more impressive when you start hosting open houses. Clean up all weeds, leaves, and debris, and consistently water to give it that fresh green look. Mow regularly, but not too short or you’ll damage the grass and invite weeds (experts recommend a minimum 3″ height for the Pacific NW). Consider a nitrate-rich fertilizer to keep the grass extra lush and green.

2. Refresh Your Door

Your front door is an opportunity to make a tasteful statement. Look at bold color choices that are within or slightly stretch your home’s exterior color palette. Take time to prepare the surface for a fresh coat of paint to make the color pop as much as possible and try stylish doorknob options that accentuate the aesthetic to give your door some added flair.

3. Update Your House Numbers

New and stylish house numbers are an easy, eye-catching addition to how your home is perceived by buyers. Look for styles that match with your exterior color palette and any exterior lighting fixtures.

4. Plant Colorfully

Adding colorful variety to your front yard will grab buyers’ attention. Align smaller plants like ground cover and flowers neatly within your flower beds, aiming for symmetry when possible. Use larger plants and trees to frame in your entryway or walkup. If your front yard doesn’t have flower beds, try adding hanging planters or window boxes. Because you’ll be competing against nearby listings, it’s landscaping projects like these that can make all the difference in your listing photos.

5. Upgrade Your Lighting

Adding landscape lighting will boost your curb appeal during nighttime, accentuate your shrubbery, and add a welcoming touch for potential buyers, lighting the way to your door.

While we’re on the subject, make sure your house lights are functional. Consider replacing dated fixtures with stylish new versions. Features like automatic dawn-to-dusk sensors will also come in handy if the home will be vacant while it’s listed.

6. Power Wash

Pressure washing your walkways and driveways can instantly improve your curb appeal. If buying a pressure washer is outside your budget, explore rental options from hardware stores in your area.

7. Add an Inviting Touch

Incorporating classic front porch elements like a porch swing, sitting bench, and other outdoor furniture gives a welcoming aura to your home’s entry and creates a sense of comfort for prospective buyers.

Adapted from an article that originally appeared on the Windermere blog April 19th, 2023. Written by: Sandy Dodge.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2023, Windermere Real Estate/Mercer Island.

7 Ways to Make Life Easier When Selling Your Home

When it’s time to sell a home, we all dream of a flawlessly executed transaction where everything goes smoothly and ends with a win-win for you and the buyer. Here are seven tips to help make that happen—and avoid surprise expenses along the way…

1. Repair Your Home First

Making repairs to your home before you sell not only makes it more appealing to buyers, but it can also help you avoid the additional costs that can result from the buyer’s inspection. Disclosing any repairs that still need to be made will help you move smoothly to closing and avoid problems that could otherwise kill the deal. Consider conducting a pre-listing inspection to make sure everything is out in the open before you sell.

2. Make Sure Your Price is Right

The key to selling your home quickly is to find the right buyers. To find the right buyers, your home must be correctly priced. I use a Comparative Market Analysis (CMA)—a thorough, data-backed examination of your home and how it compares to other listings in your area—to accurately price your home. Without an agent’s CMA, it’s easy for your home to be listed at the wrong price.

-

- Avoid Overpricing: Overpricing your home will attract the wrong buyers because you will force your home into competition with other listings that are fundamentally superior or have more to offer. When comparing other homes to yours, buyers will focus on the discrepancies and the features your home lacks. Overpricing will often cause homes to sit on the market for extended periods of time and become less appealing to buyers.

-

- Avoid Underpricing: Under competitive market conditions, intentionally underpricing a home is a common strategy to attract buyer attention with the goal of starting a bidding war to drive the price of the home up. However, several things must go correctly for this to happen. In all other cases, underpricing your home reflects a lack of knowledge about where its market value fits into the fabric of current local market conditions and can leave you, the seller, unsatisfied with the price your home ultimately fetches.

3. Invest In Staging & Professional Photography

First impressions matter when selling a home. The vast majority of buyers are searching online and taking virtual tours of homes they’re interested in. As such, it’s well worth the time and money to hire a high-quality photographer and I always provide this for my sellers. The right photography can make all the difference in the minds of buyers.

Home staging is also a critical element for getting the most value for a home and selling it quickly. You can even DIY if you have the time and modern decor. It’s also the perfect time to inspect your home for any minor or cosmetic repairs that can be addressed quickly. An aesthetically pleasing home will attract more eyes, and any edge you can give your home over competing listings may be just the ticket to getting it sold.

4. Keep Your Emotions in Check

Selling your home is an act of learning how to let it go. Once you know you’re ready to sell, you’ll need to be able to look at it with an objective eye. This will allow you to approach decisions from a neutral standpoint and work towards what is best for the sale of the home. Having clear judgement will also help you get through the negotiating process and steer yourself toward a smooth closing. Stepping back can be tough, but a good agent will always be happy to give you guidance and help you keep perspective.

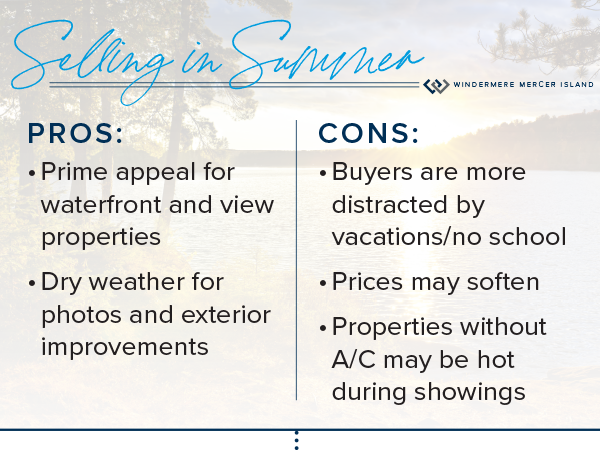

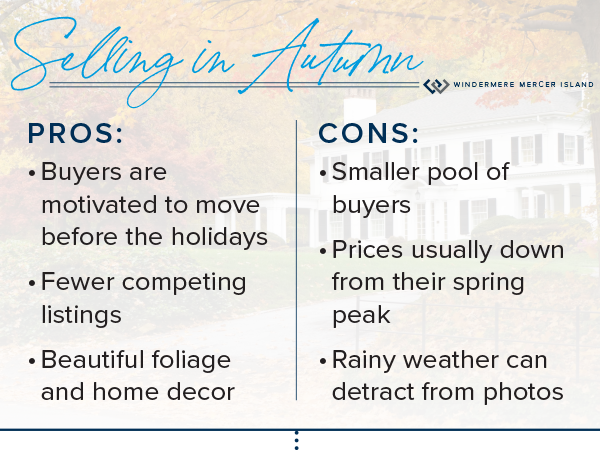

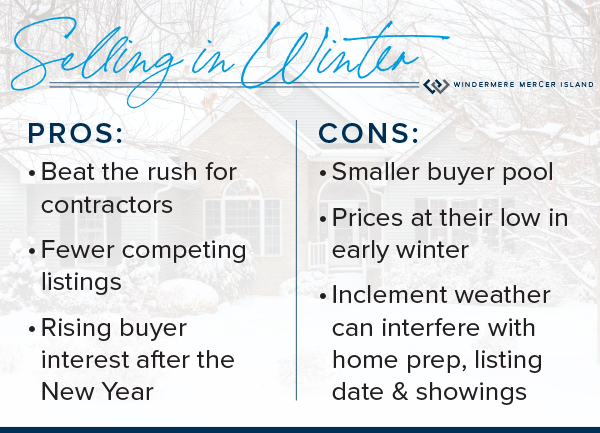

5. Wait Until You’re Ready

It may be tempting to rush your listing to take advantage of local market conditions, but waiting until you have all your ducks in a row will make life so much easier. Knowing when to sell your home is a mixture of being financially prepared, having the right agent, and understanding how your home fits into the current local market landscape. Once you’re ready, here are some tips on timing the market.

6. Use an Agent

…and I’m not just saying it because I’m an agent! Selling a home “For Sale By Owner” (FSBO) can save on commission fees, but is a complex and risky process that can easily lead to serious costs. An agent will help you front marketing costs, provide sound advice to help you avoid legal trouble, and ultimately shoulder some of the liability for the transaction. Being represented by an experienced professional will help you avoid mistakes during the offer process, negotiations, and closing that could otherwise be costly or jeopardize the sale. It’s no wonder that a vast majority of sellers choose to work with an agent.

7. Be Willing to Negotiate

Approaching buyers’ offers with an open mind will ensure you don’t miss any opportunities. Before the offers start to come in, it’s important to work with your agent to understand your expectations and strategize which terms and contingencies you’re willing to negotiate on. That way, you can quickly identify the right offer when it comes along. Showing a willingness to work with buyers will also keep them engaged and make sure you don’t leave potential deals on the table.

© Copyright 2023 Windermere Mercer Island.

Adapted from articles that originally appeared on the Windermere blog, November 22, 2021 & April 7, 2021, by Sandy Dodge.

Q4 2022 Western Washington Economic & Real Estate Update

The following analysis of select counties of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. I hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me.

Regional Economic Overview

Although the job market in Western Washington continues to grow, the pace has started to slow. The region added over 91,000 new jobs during the past year, but the 12-month growth rate is now below 100,000, a level we have not seen since the start of the post-COVID job recovery. That said, all but three counties have recovered completely from their pandemic job losses and total regional employment is up more than 52,000 jobs. The regional unemployment rate in November was 3.8%, which was marginally above the 3.7% level of a year ago. Many business owners across the country are pondering whether we are likely to enter a recession this year. As a result, it’s very possible that they will start to slow their expansion in anticipation of an economic contraction.

Western Washington Home Sales

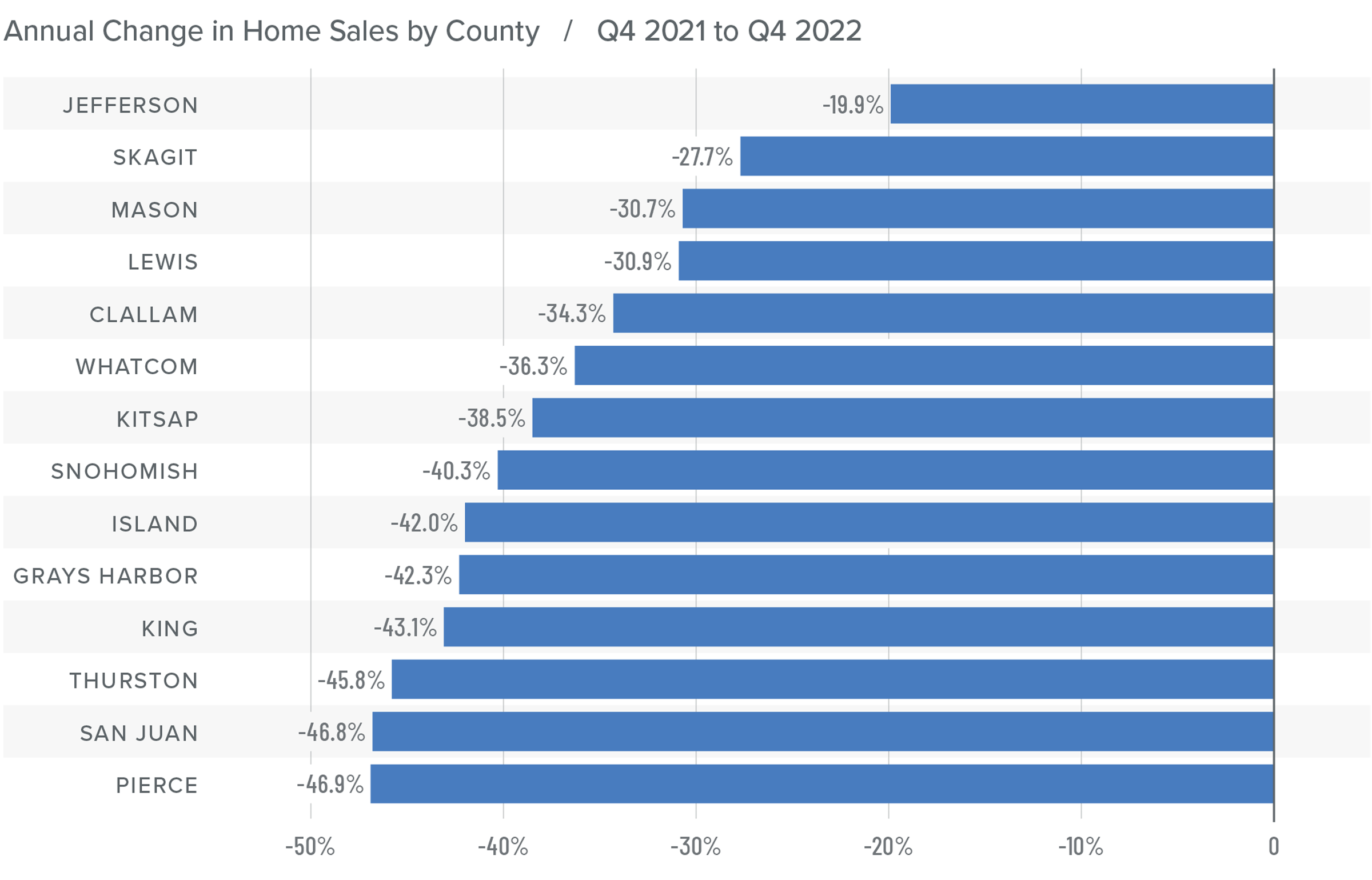

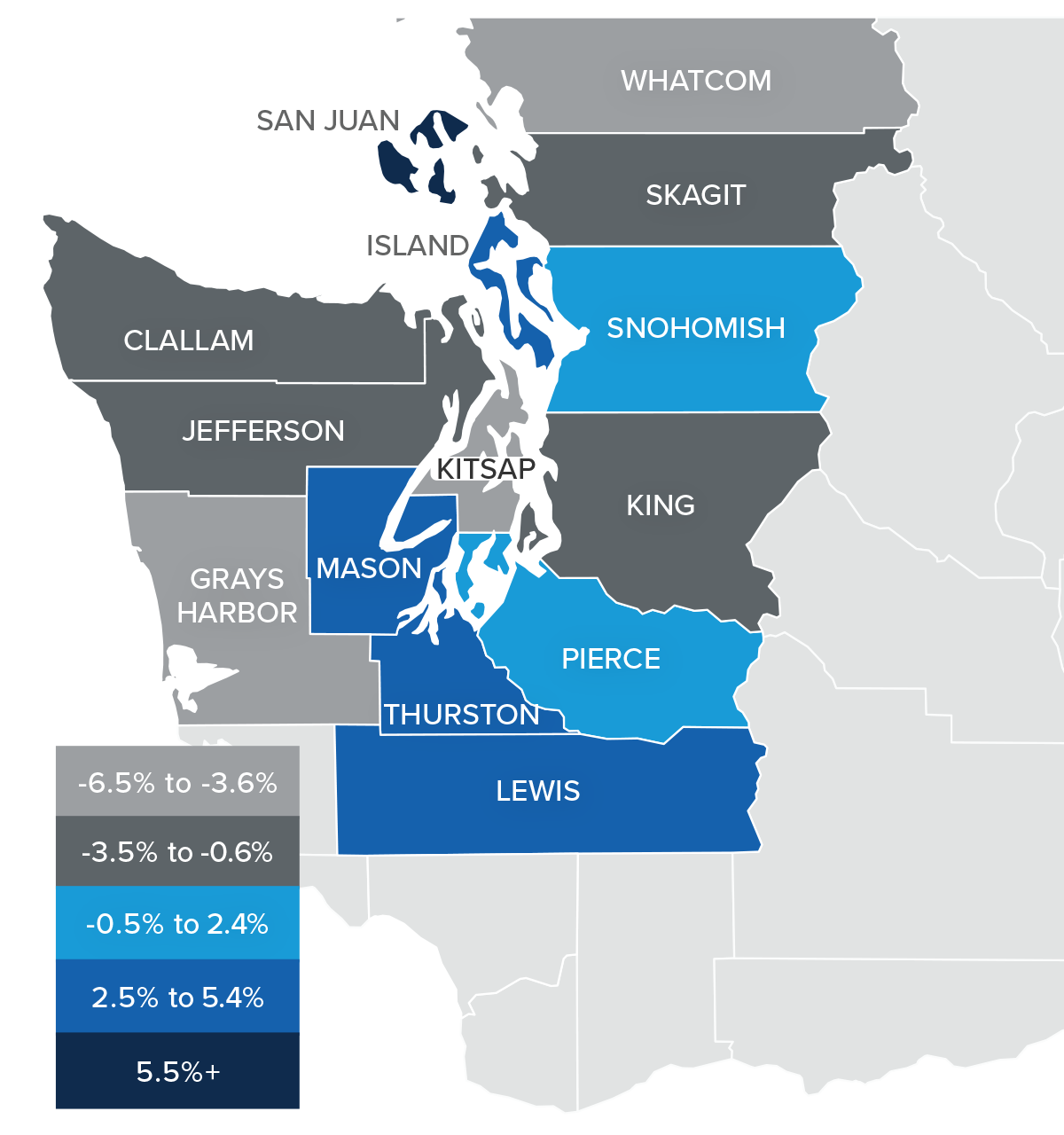

❱ In the final quarter of 2022, 12,711 homes sold, representing a drop of 42% from the same period in 2021. Sales were 34.7% lower than in the third quarter of 2022.

❱ Listing activity rose in every market year over year but fell more than 26% compared to the third quarter, which is expected given the time of year.

❱ Home sales fell across the board relative to the fourth quarter of 2021 and the third quarter of 2022.

❱ Pending sales (demand) outpaced listings (supply) by a factor of 1:2. This was down from 1:6 in the third quarter. That ratio has been trending lower for the past year, which suggests that buyers are being more cautious and may be waiting for mortgage rates to drop.

Western Washington Home Prices

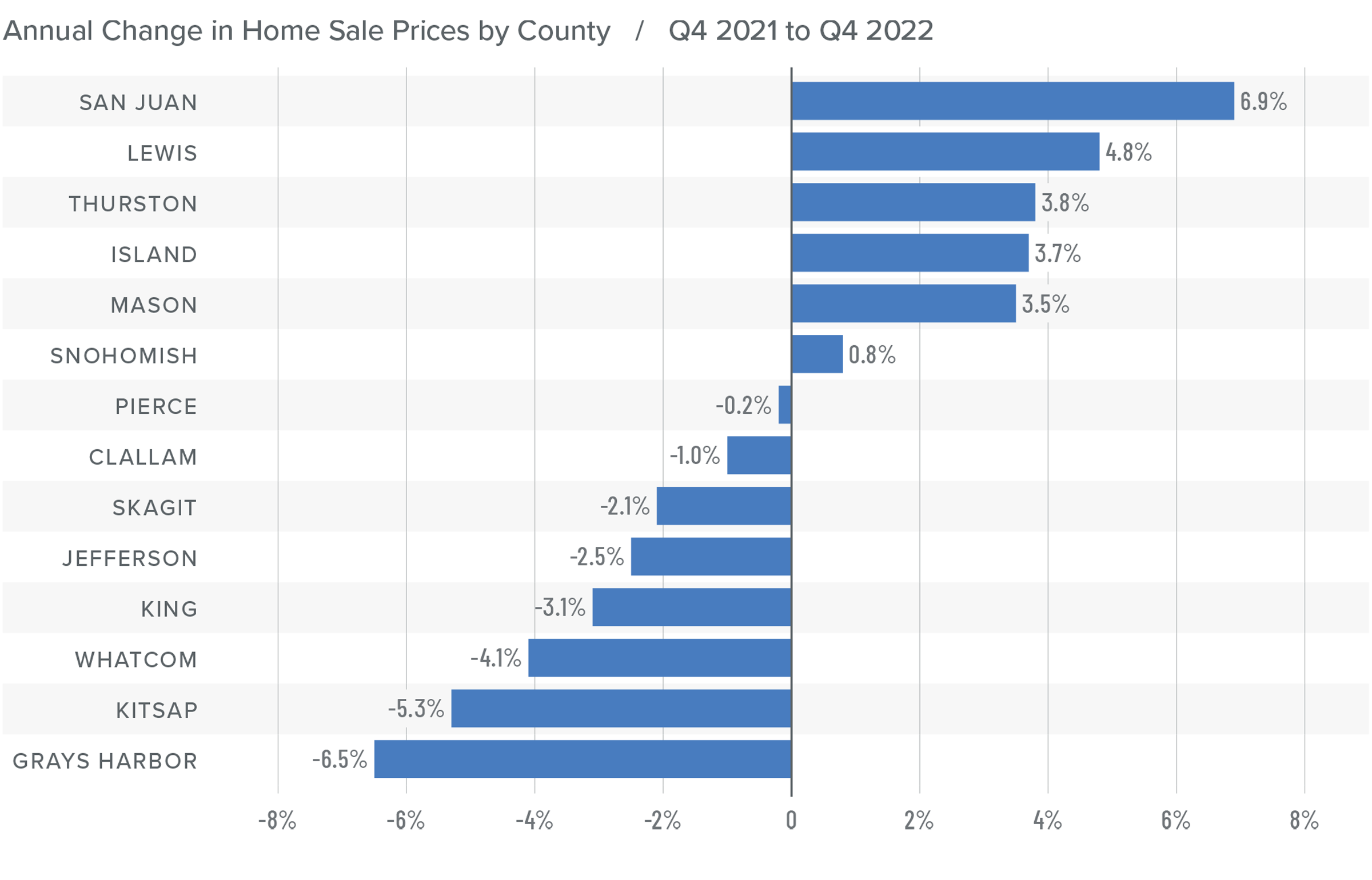

❱ Sale prices fell an average of 2% compared to the same period the year prior and were 6.1% lower than in the third quarter of 2022. The average sale price was $702,653.

❱ The median listing price in the fourth quarter of 2022 was 5% lower than in the third quarter. Only Skagit County experienced higher asking prices. Clearly, sellers are starting to be more realistic about the shift in the market.

❱ Even though the region saw aggregate prices fall, prices rose in six counties year over year.

❱ Much will be said about the drop in prices, but I am not overly concerned. Like most of the country, the Western Washington market went through a period of artificially low borrowing costs, which caused home values to soar. But now prices are trending back to more normalized levels, which I believe is a good thing.

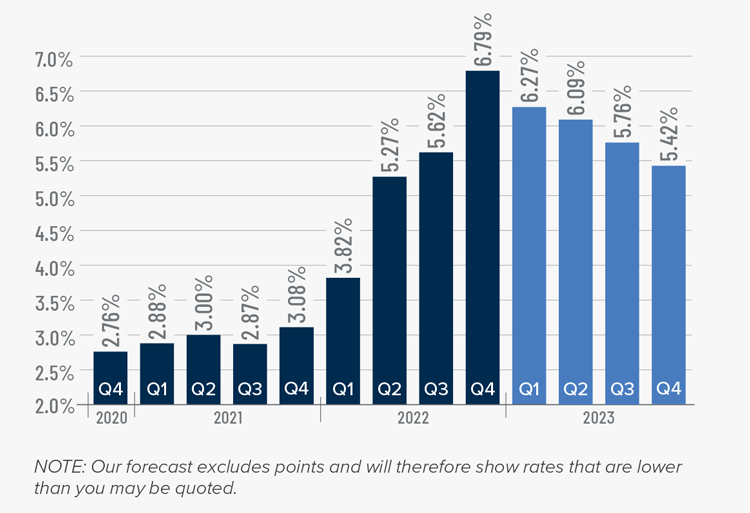

Mortgage Rates

Rates rose dramatically in 2022, but I believe that they have now peaked. Mortgage rates are primarily based on the prices and yields of bonds, and while bonds take cues from several places, they are always impacted by inflation and the economy at large. If inflation continues to fall, as I expect it will, rates will continue to drop.

My current forecast is that mortgage rates will trend lower as we move through the year. While this may be good news for home buyers, rates will still be higher than they have become accustomed to. Even as the cost of borrowing falls, home prices in expensive markets such as Western Washington will probably fall a bit more to compensate for rates that will likely hold above 6% until early summer.

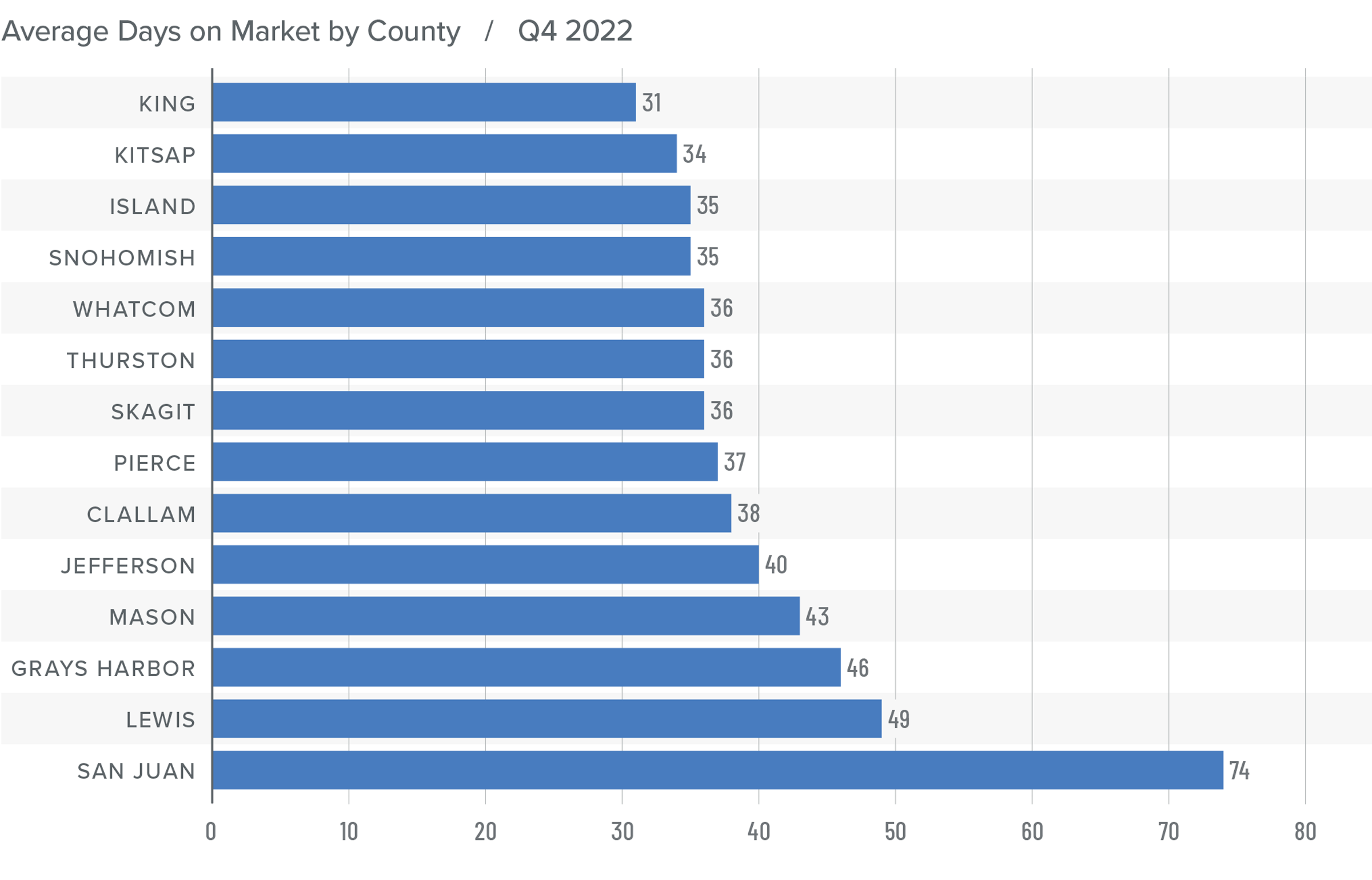

Western Washington Days on Market

❱ It took an average of 41 days for homes to sell in the fourth quarter of 2022. This was 17 more days than in the same quarter of 2021, and 16 days more than in the third quarter of 2022.

❱ King County was again the tightest market in Western Washington, with homes taking an average of 31 days to find a buyer.

❱ All counties contained in this report saw the average time on market rise from the same period a year ago.

❱ Year over year, the greatest increase in market time was Snohomish County, where it took an average of 23 more days to find a buyer. Compared to the third quarter of 2022, San Juan County saw average market time rise the most (from 34 to 74 days).

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The regional economy is still growing, but it is showing signs of slowing. Although this is not an immediate concern, if employees start to worry about job security, they may decide to wait before making the decision to buy or sell a home. As we move through the spring I believe the market will be fairly soft, but I would caution buyers who think conditions are completely shifting in their direction. Due to the large number of homeowners who have a mortgage at 3% or lower, I simply don’t believe the market will become oversupplied with inventory, which will keep home values from dropping too significantly.

Ultimately, however, the market will benefit buyers more than sellers, at least for the time being. As such, I have moved the needle as close to the balance line as we have seen in a very long time.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This article originally appeared on the Windermere blog January 26th, 2023. Written by: Matthew Gardner.

© Copyright 2023, Windermere Real Estate/Mercer Island.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link